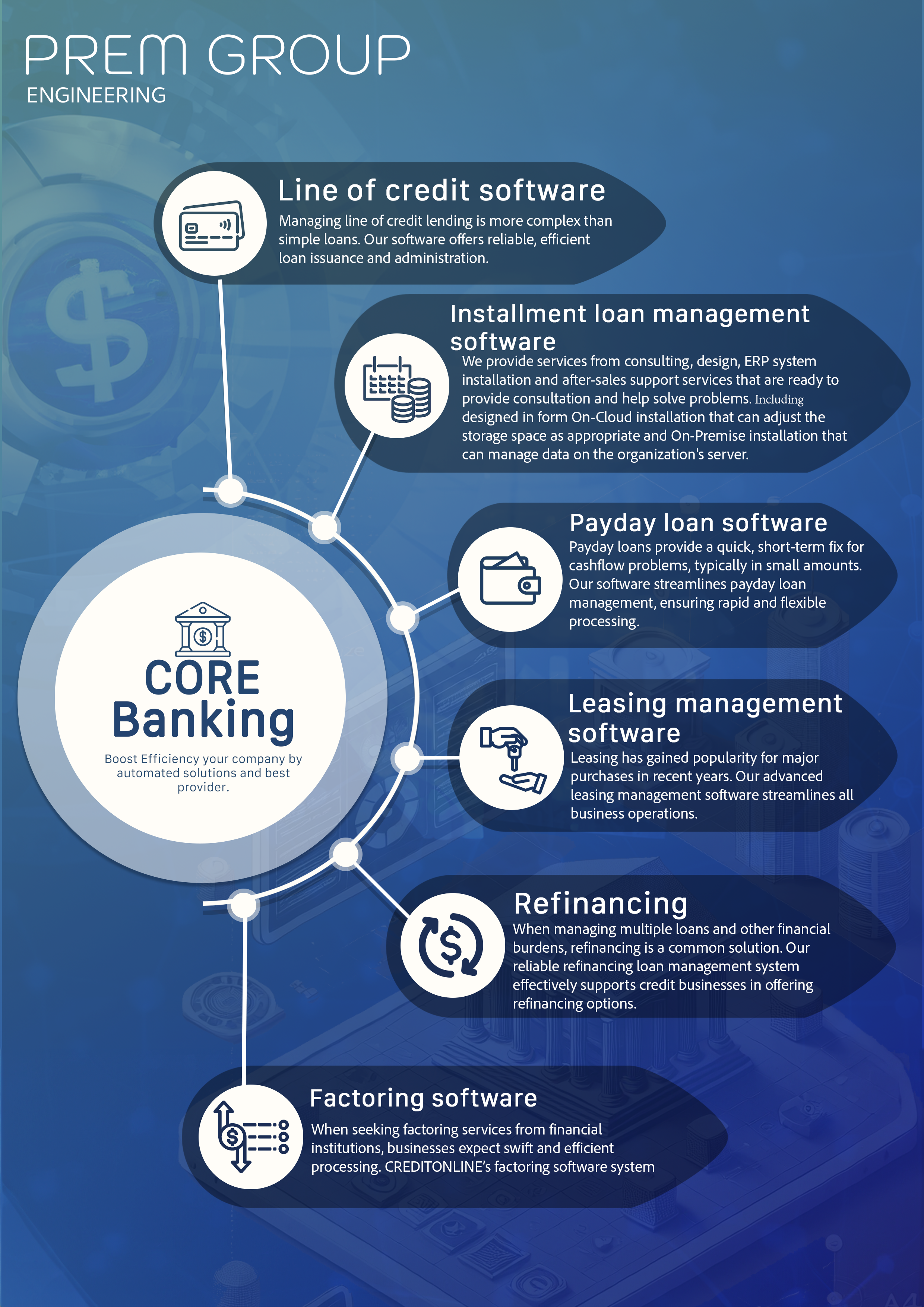

When facing the prospect of repaying one or more loans, sometimes people need to find a way to solve other financial burdens and liabilities. In this situation refinancing becomes the most common solution. Our dependable refinancing loan management system is an effective solution for credit businesses looking to provide refinancing loans.

When applying to a financial institution to support with factoring, businesses expect the process to be done quickly and efficiently.factoring software solution is a time-tested software system that allows financial institutions to provide a range of factoring services.

Installment loans are the basic service that all credit providers offer and are issued every day. we aim to make the loan management process as simple as possible for our customers. Our loan management software has a wide range of features and lots of different functions to ensure smooth lending.

Payday loans are a fast and short-term solution to cashflow issues and are usually issued in small amounts. Payday loans require lenders to act fast. We have developed a flexible and easy to issue payday loan software to ensure smooth administration of payday loans.

Managing the line of credit lending process can be complex in comparison to simple lending. Our line of credit software is extremely reliable and allows for an easy and efficient loan issuance and administration process.

Leasing has become more popular in recent years with many choosing leasing options when purchasing big ticket items. Our leasing management business system is a modern software system that enables you to manage all business processes effortlessly.

One of the main loan providers that is often overlooked are Universities. Universities are some of the largest loan providers in the world with most modern day students taking the option of financing their studies through some loan provider, finance institution or university loans, grants and scholarships. Seeing that every year university applicant numbers are growing, it puts more pressure on universities to manage their credits, instalments and repayment schedules, let alone interest rates and repayment dates. As these numbers grow, universities are forced to expand their financial departments and spend more to adapt to these ever increasing numbers.

We offer a solution to universities looking to save resources and manage student loans in a more effective and time-saving manner. This means that instead of needing a finance department, a university is able to rely on our software to complete the work for them. This decreases the chances of man-made errors, lost documents and contracts, countless hours spent categorising students and sending updates and following up and chasing repayments. We can automate the loan issuing process to, for example, be a portal on the university website that students can submit documents to, enter personal information and apply for loans. The loan applicants can be automatically cross-referenced against extensive databases for their suitability for the loan they are applying for and approved manually, semi-automatically or fully automatically if certain client pre-defined criteria is met.

With energy prices soaring it is not uncommon for more and more homes to be opting into a greener and more sustainable energy. we recognise that as more and more homes and business are making the change to renewable energy they are faced with issues such as understaffing, difficulty in record keeping and managing the business and volume of requests / installations. It is also more and more evident that we have already begun the shift to the digital age where services are sought online instead of through cold calls or salesmen. However, with Solar Energy for your home still being a relatively new concept, although there may be online purchase options, there are no software solutions for business looking to enter the market.

With the installation of solar energy solutions being pricey at best, many homes are forced to take out some type of payment plan to pay back the cost of the panels over a period of months, years or even decades. These repayment plans are usually combined with extensive but exhaustive contracts, sign up processes and multiple meetings taking up valuable employee efforts that could be dedicated to more useful processes. Therefore is offering a solution to the tedious record creating and keeping process. The Green option is about offering you a tool which allows you to do more with less.

Buy Now Pay Later (BNPL) is a tried and tested strategy for moving bigger-ticket items off the shelves and into your possession. It comes as no surprise then that millions of people use it worldwide every day! This means you can shop at your favourite stores, local malls or anywhere only and then choose to check out using the BNLP method. The information you will find below will provide some insight into BNPL, our software and the benefits of using it along with some key features.

Buy now, pay later apps allow you to make purchases online and pay them off over time in weekly, bi-weekly, or monthly instalments. These apps sometimes charge interest, much like a credit card, but they may offer "interest-free" periods. If you pay off your balance before the period ends, you can avoid paying interest altogether. Although this at first glance may appear risky, according to a report by consumer-credit-rating agency Experian1, “Consumers continue to manage credit well and the average credit score climbed seven points since 2020 to 695, the highest point in more than 13 years.”

The financing industry is becoming increasingly digitised as borrowers look for fast and easy ways to raise funds. Our automated digital lending software will help you streamline your loan management processes, from origination to repayment, with a system tailored to your needs.

Digital lending utilises online technology throughout the financing process. The involvement of digital platforms ranges, from simple online applications to full scale automated loan origination software. The introduction of digital technology into the lending industry started in 2005, and since then it has developed to become a keystone in today’s market. This is hardly surprising given the significant benefits to both lenders and consumers, including more convenient applications and faster processing of loans for seamless end-to-end management. For more information on the benefits check out our blog post comparing digital and traditional lending.

Payday loans are granted on the same day or as soon as possible. To ensure efficient payday lending, quality software is required. offers payday loan software that allows smooth administration of loans with flexibility and ease. The below information provides more information about payday loans, our software, the benefits of using it and some key features.

Payday loans are fast, short-time loans. Payday loans are usually issued in small amounts compared to other high street loans. It is worth noting that payday loans can often have higher interest rates, it is vital this is considered before issuing a loan to ensure the applicant can make repayments. Payday loans often do not have a monthly repayment schedule as they are usually repaid in a single payment within a specified period set by the payday loan lender. Payday loans can be provided by banks, credit unions and other financial institutions.

Every credit business should provide installment loans to their customers. The credit business may choose to offer consumer loans, guarantor loans or secured loans. Installment loans will be issued every day. As installment loans form a large part of most credit businesses, it is vital that a reliable loan management system is in place to ensure positive results.

Installment loans allow you to borrow a set amount of money. Unlike line of credit loans or credit cards you must decide the total amount you would like to borrow before borrowing any funds. Installment loans are paid back of a fixed period of time, typically via monthly payments but repayment schedules can vary depending on the provider.

Leasing is a common way to purchase high value items. To ensure a smooth experience for your customers it is important to utilise a high quality, effective leasing business management system. Our modern software solutions will allow you to manage all of your business processes easily and in one place.

Leasing allows customers to purchase desired products and use them from the day of purchase whilst the ownership of the product remains with the leasing provider. During the period a customer uses that product, they will make payments to the leasing provider until the end of the contract or until the customer becomes the owner. The customer can take ownership of the product from the leasing provider once the outstanding balance has been cleared.

Sometimes people with multiple loans get overwhelmed by loan payment schedules or high interest rates. Often they will look for solutions to help them manage their budget issues. In this case, refinancing becomes the most common solution for those who are struggling because of financial liabilities. If you are a business offering refinancing to customers then you will require an efficient loan management system to ensure smooth refinancing of loans.

Refinancing allows those facing problems repaying multiple loans to reduce their financial burden. One of the best solutions is to borrow a new loan to cover any previous loans, this is known as refinancing. It doesn’t matter whether the loans are from consumer loans, leasing or credit companies, refinancing will consolidate all loans into one and provide better repayment terms. That is why for many refinancing is an attractive option.

Invoice finance is a common cause of poor cash flow in businesses that result in them applying to financial institutions for assistance. As a result, businesses expect factoring to be smooth and efficient. For financial institutions offering factoring services, reliable software solutions are vital. Our time-tested software system allows you to successfully provide high quality factoring services to your clients.

Factoring is a service provided by a financial institution, namely a bank or factoring company to a business. The factoring company will facilitate the payment of working capital and accounts receivable to a third party in order to provide a business with immediate cash. This is common practice for businesses who are dealing with cash flow problems or a large number of late invoices.

The line of credit lending process is much more complex than that of simple lending.line of credit software is a reliable and efficient software solution that allows for an easy loan issuance and administration process.

Line of credit is a permanent way of financing working capital. The bank or financial institution sets a borrowing limit and the company (client) can borrow up to this limit at its convenience. The advantage of line of credit loans compared to simple loan issuance is that the borrower saves time as the financial institution doesn’t have to constantly assess the risk of the loan repayment or interest repayments.

As the world changes so does the world of lending and in recent years crowdfunding has become a popular way for businesses and individuals to raise funds for new ventures.

Crowdfunding is a method of raising finance by asking a large number of people to contribute a small sum of money to finance a project. Traditionally, borrowers would need to speak to a range of lenders to raise their funds which can be very time consuming. Crowdfunding allows an individual or business to talk to thousands of people via the power of the internet. This form of raising finance often results in target figures being raised much faster than traditional lending methods.

If you are looking for an alternative lending method than Peer to Peer finance also known as P2P might be right for you. Keep reading to discover what Peer to Peer lending is, the advantages, disadvantages and how We can help.

Peer to Peer lending is an alternative lending method that is becoming more popular across the globe and in particular in the UK and Europe. It is a digital lending method that matches borrowers with lenders using an online platform or broker. Unlike traditional lending methods, P2P puts borrowers in direct contact with lenders cutting out the middleman. P2P lending is a great alternative if your business or project doesn’t meet traditional lending methods criteria or is in need of financial support fast.